The footfall equation

- In Innovation

- 11:27, 18 november 2020

- 3246 Views

Proptech, including big data and artificial intelligence (AI), has been billed as the solution for a number of the property industry’s woes for some time.

Even pre-pandemic, McKinsey argued that commercial real estate was obliged to adopt technology to thrive – while shopping centre owners and operators would need to instil a culture of fact-based decision making throughout the organisation by collating the right data and adopting the means to process in.

Yet despite the increasing presence in retail assets of tools ranging from beacons to granular Wi-Fi, facial-recognition cameras to loyalty cards, the desire to track and trace (pun intended) customer behaviour has for some, only really crystalised now that footfall caps have become a Covid-19 reality.

‘What we’ve seen around Covid-19 is more adoption on the hardware side where landlords have had to quickly re-specify buildings,’ says Matthew McAuley, director in global research at JLL.

High-frequency data in particular is in demand to help make decisions – especially relating to health, mobility and space usage.

‘For landlords, data helps them see how they sit among their peers,’ McAuley says. ‘For governments, it’s about seeing where the distress is, and for investors it’s about pricing and strategic implications.’

For Erik Guertler, founder of AI-powered proptech firm Edge AI, the time is right for the industry to act. ‘Retail real estate is changing dramatically,’ Guertler notes. ‘The only valid variance of opinion is in the degree of change. Big data and AI in retail is being used to shape its future by making shopping easier, more convenient and more interesting.

‘AI proptech solutions collect and deliver data that retailers can easily convert into meaningful insights and actionable outcomes. From people counting devices at store entrances to location-based technologies monitoring shopper movement, Proptech solutions can build a comprehensive picture of the shopper journey and customer behaviour in stores and shopping centres. Managing visitors is important as it improves the customer journey and retail-place efficiency.’

Proptech options

Shopping centre owners and managers today have a number of tools at their fingertips in the increasingly granular proptech ecosystem. Sensormatic Solutions says its data helps retailers monitor factors ranging from loss and liability to traffic insights, passing through inventory intelligence. LocateAI plugs into millions of mobile devices to help landlords understand foot traffic, car traffic and consumer behaviour.

Other platforms, including VPod, Placemake.io and Placense all offer behavioural insights and demographic snapshots to deepen landlord and retailer understanding of the customers they already have and would like to woo.

Landlords working with these firms are able to curate their own bespoke solutions to match the needs of their portfolios. For example, UK-based shopping centre owner Capital & Regional developed and launched a new technology partnership with Sensormatic this summer.

The venture modifies the landlord’s ShopperTrak solution to monitor and help control individual centre occupancy levels in real time.

Through the partnership, centre teams are able to track peak and non-peak trading times and compare it to historical data, informing Capital & Regional’s green-amber-red ‘traffic light system’ already being used in its properties to guide footfall.

Moreover, general managers receive SMS alerts as their centre nears maximum capacity. The data also helps improve discussions with its retailer customers regarding centre occupancy trends.

Nick Pompa, general manager, EMEA regional business at Sensormatic says: ‘During this challenging and critical time for retail property, we are working closely with the industry to help deliver shopping experiences that are both safe and frictionless while providing safety that is reassuringly visible but executed as seamlessly as possible – a feat that is only achievable through collaboration and well-applied data.’

Outlet innovation

The typically innovative outlet centre industry has also been exploring new proptech solutions for pandemic times. In October, designer outlet group McArthurGlen piloted two new digital shopping services to help customers avoid the crowds.

The group has teamed up with By Appointment, a global appointment scheduling and queue management system which enables customers to book times to shop at participating stores, as well as monitor and join real-time virtual queues from their smartphone.

It is initially being trialled in the group’s outlets in Serravalle (Italy), Roermond (the Netherlands), Cheshire Oaks (the UK) and Berlin (Germany). The firm has also rolled out digital handsfree shopping service Dropit at Cheshire Oaks, the UK’s largest designer outlet.

Using a smartphone, shoppers can arrange to securely drop off their acquisitions in participating stores and programme home delivery times to locations that are most convenient to them.

Susie McCabe, deputy chief executive officer at McArthurGlen says: ‘By integrating these two innovative, app-based services into the McArthurGlen offer, we are delivering even greater convenience and flexibility for our guests, while enhancing their safety and wellbeing.’

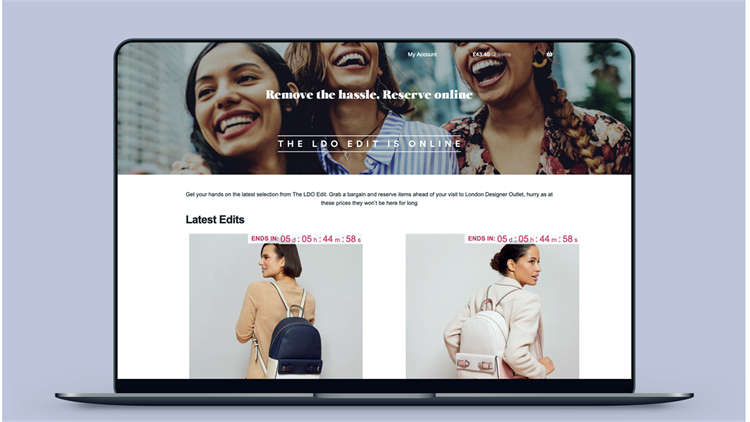

Elsewhere, the London Designer Outlet (LDO) has introduced what it describes as ‘the UK’s first click-and-reserve outlet shopping platform’ with the launch of The LDO Edit, an ecommerce site linked to the outlet’s physical retail offer which features additional, time-limited discounts on top of the centre’s existing 70% discounts.

Overall, the combination of new hardware, analytical expertise and the desire to innovate is placing the industry at an inflection point where real and rapid gains from data usage are possible, while the pandemic prompts a meaningful shift in how data is used.

‘High-quality information that reflects fast-changing market conditions is invaluable during periods of market turmoil and many data providers covering niche property types have illuminated otherwise opaque market metrics,’ says Jeremy Kelly, lead director, global research, JLL.

The hope is that today’s advances could help to fast-track digitisation across the industry beyond the specific data points from managing the Covid-19 crisis.

‘These innovative efforts, organised in reaction to the market disruption resulting from Covid-19 highlight how transparency progress is possible when it is made a priority,’ Kelly concludes.