LPP westward bound for expansion

- In Strategy

- 16:03, 14 april 2017

- 1097 Views

Poland’s most successful retailer LPP is in expansive mood at it looks west for international growth.

In September LPP’s flagship brand Reserved will debut in the UK, on London’s Oxford Street, in a former BHS department store. The brand will also launch online in the country.

The Polish company admits that the UK expansion is a big move. ‘It is intended to show our customers

that we are a brand with global ambitions, ready to make our mark in the world’s most competitive retail market,’ says Krzysztof Bocianowski, head of expansion and leasing at LPP.

Retail analysts will be watching how the company fares in the UK. The market is a notoriously hard nut

to crack for newcomers because of greater overall competition and differing fashion tastes. However,

opening a flagship store on one of London’s busiest shopping streets shows a confidence gained by having successfully taken on bigger players such as Inditex and H&M in LPP’s home market of Poland, and again in neighbouring CEE markets.

As Charlotte Mahoney from retail real estate analysts PMA puts it: ‘LPP has been smart enough to adopt a

similar strategy to its larger, more established counterparts in rolling out a stable of brands (Reserved,

Cropp, House, Sinsay, Mohito) aimed at different target groups.’

Germany gateway to the west

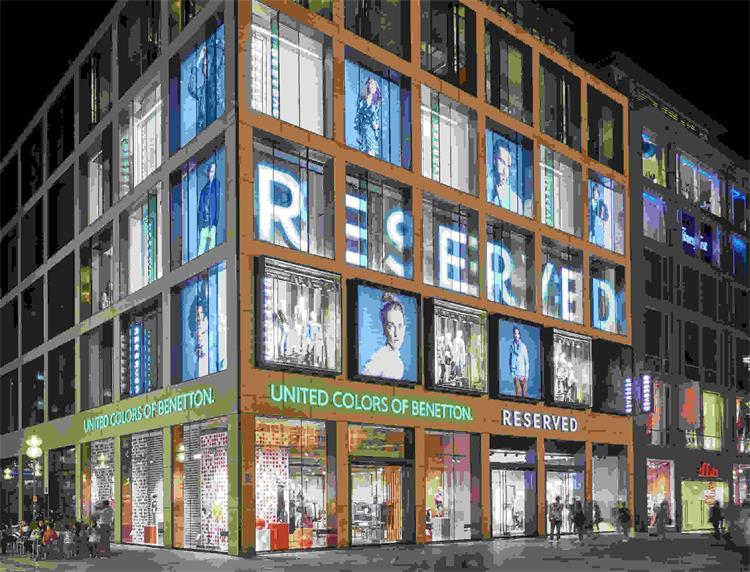

The company’s stride westwards has been going on for some time. In March LPP opened two new

flagship stores in Germany, its 17th Reserved brand-ed store on Spitalerstraße in Hamburg with 2,700 m2 store of retail space over three floors, and 18th in Cologne (2,800 m2).

This year will also see the brand expand its network into Serbia, Belarus and Kazakhstan. Germany is now the fourth-largest market for LPP in terms of revenue, despite the fact that only 17 of its 1,700 stores are located there. Last December it opened stores showcasing its younger brands Cropp, House, Mohito

and Sinsay, and it will open another Reserved store in Berlin this May, bringing the total number of German shops to 19.

But its expansionist ambitions don’t stop there. LPP will also accelerate its development in Russia and Ukraine, where it plans to open new stores and launch online sales of all its brands. Total investment

in 2017 will amount to around PLN 440 mln (€102 mln), the company says. Not everything LPP does turns to gold, though.

Last year, the main challenges for the company were the condition of the Reserved brand, lower profit margins throughout the apparel industry, wholesale of inventories and liquidation of its new Tallinder brand, less than a year after its launch in February 2016. Sales results for the new higher-end brand were far below expectations and the company acted quickly. The press release announced: ‘In the opinion of the management board, the current financial condition of the company does not allow it to bear the high costs associated with the development of the Tallinder brand in the long term.’

LPP was co-founded in 1991 by Marek Piechocki, now president of the management board, and Jerzy Lubianiec, president of the supervisory board. In 1995 the company renamed itself LPP (after Lubianiec, Piechocki and Partners).

International expansion

LPP’s first foray into retail real estate was with the opening of its first Reserved stores in 1998. By 2001 the company had listed on the Warsaw Stock Exchange. The following year saw the start of its international expansion, into nearby Estonia, the Czech Republic, Russia, Hungary, Latvia, Slovakia, Lithuania and Ukraine.

Armed with two brands – Reserved and new brand Cropp – further expansion followed. In 2008, as a result of a merger with Artman, which owned brands House and Mohito, LPP became the largest clothing company in Poland and an international retail player. By 2013, the company was ready to launch a new brand – Sinsay – and it continues to expand its brands across Europe.

So where does LPP see future opportunities for the retail fashion industry? It’s a challenge, says the company spokesman. Retailers must ‘adapt to the pace of change, or face being outstripped by competitors’, says Bocianowski. ‘Having the agility to deal with the changing way people view and shop for fashion, as well as what they expect from a fashion brand, will be crucial. This is where the opportunity lies, in finding creative ways to remain relevant.’

E-commerce and logistics

A stated goal for the company is for its revenues to grow faster than the retail area of its stores, which means being flexible and responsive to the ever-changing nature of the industry. E-commerce is therefore a central part of its strategy. Good logistics help here too. LPP owns the largest clothing distribution centre in Central and Eastern Europe, located outside Gdansk. It currently supports more than 1,700 stores sending out over a million products daily.

The company says e-commerce is a rapidly growing market and ‘one that we are keen to grow in line with our business’.

Ultimately, LPP wants its online offering to extend across all operational markets. ‘By 2020 we hope it will

generate between 7-8% of our revenue. Our plans for this year include launching the online sales of Reserved, Cropp, House and Sinsay in Russia, Ukraine and the Baltic states as well as the online sales of Reserved in the UK.’

BOX

FAST FACTS ON LPP

• FOUNDED in 1999, LPP has built the largest clothing company in Central and Eastern Europe

• Its BRANDS are worn by people in 18 countries across Europe, Africa and Asia

• LPP MANAGES a chain of more than 1,700 outlets

• It creates more than 22,000 JOBS across Warsaw, Gdansk, Hamburg, Shanghai, Prague, Moscow, Kiev,

Budapest and other locations

• LPP’s brands are PRESENT in Poland, Germany, the Czech Republic, Slovakia, the Baltics, Ukraine, Romania, Bulgaria, Hungary and Croatia

• In 2015 the company EXPANDED into the Middle East where it is present in Egypt, Qatar, Kuwait and Saudi Arabia

• In 2016 it OPENED a store in the UAE

• DESIGN work is done at the company’s Gdansk headquarters, and in Krakow

• PRODUCTION is outsourced to contractors in Asia, Turkey and Poland. It has offices in Shanghai and Dhaka, Bangladesh

• LPP aims to become one of the TOP 5 clothing companies in Europe

• In 2016 alone it SOLD more than 120 million items of clothing and accessories, with REVENUES in excess of €1.4 bn, up 17% compared to 2015

• Gross MARGINS amounted to almost 49%

• LPP’s revenues from ONLINE sales increased by as much as 118% in 2016

• In 2017 LPP will DEBUT in four new markets and will launch online shops in six countries